The AI Bubble: Are We on the Brink of a Burst?

Key Points on the AI Bubble

- Private Markets vs. Public Companies: The AI bubble is more pronounced in private markets, where venture capital fuels high valuations for startups like OpenAI, often based on hype rather than proven revenue. In contrast, large public companies like Google and Meta benefit from diversified revenue streams, making them more resilient to a potential burst.

- Expert Warnings: Former Reserve Bank of Australia economist Martin Eftimoski has publicly withdrawn all AI-related investments from his pension, citing a lack of understanding among business leaders about AI’s practical usefulness and warning of overinflated expectations.

- Physical Barriers to Growth: AI’s rapid expansion is constrained by shortages in data center capacity and energy supplies, with projections indicating global energy demand for AI could reach 200 TWh in 2025, potentially increasing costs and limiting innovation.

Overview of the AI Hype Cycle

The AI boom has driven massive investments, but recent reports highlight a disconnect between hype and real-world returns. Studies show that while adoption is high, measurable benefits remain elusive for most organizations. Market analysts warn of corrections, yet the technology’s long-term potential persists.

Signs of Overvaluation

Investors have poured billions into AI, but skepticism is growing. Private markets show speculative bubbles, while public tech giants maintain stability through broad business models.

The world of artificial intelligence is electric with activity. Venture capitalists are pouring billions into AI startups, and tech giants are in an arms race to develop the most advanced AI models. But amidst this frenzy, a growing chorus of experts is sounding the alarm: the AI boom may be a bubble on the verge of bursting. This sentiment is not just idle speculation; it’s backed by a growing body of evidence suggesting that the hype surrounding AI is far outpacing its real-world value.

Enthusiasm Falters as ROI Fails to Materialize

One of the most significant signs of a potential AI bubble is the growing disillusionment with the return on investment (ROI) of AI technologies. A recent study from the Massachusetts Institute of Technology (MIT), titled “The GenAI Divide: State of AI in Business 2025,” delivered a sobering statistic: 95% of organizations have seen zero measurable return on their generative AI investments. This is despite a global investment of $30 to $40 billion in the technology.

This lack of ROI is beginning to impact AI adoption rates. For the first time since the AI boom began, the US Census Bureau’s Business Trends and Outlook Survey (BTOS) has shown a decline in AI adoption among large companies. Adoption among firms with over 250 employees dropped from a peak of 14% earlier in 2025 to around 12% by late summer. This suggests that the initial excitement is wearing off as businesses confront the reality that implementing AI is not a guaranteed path to profitability.

Adding to this sentiment, the respected technology research firm Gartner has placed generative AI in the “Trough of Disillusionment” in its 2025 Hype Cycle. This phase is characterized by waning interest as the initial hype fades and the challenges of implementation become more apparent. Gartner estimates it could take 2-5 years for gen AI to move toward productive use.

The Double-Edged Sword of AI in Coding

One of the most touted use cases for AI is in software development, with AI-powered coding assistants promising to revolutionize the way we write code. However, the reality is more complex. While some studies show that these assistants can boost productivity, particularly for junior developers, others suggest a “productivity placebo” effect. Developers may feel more productive, but the measurable gains are often marginal or even negative.

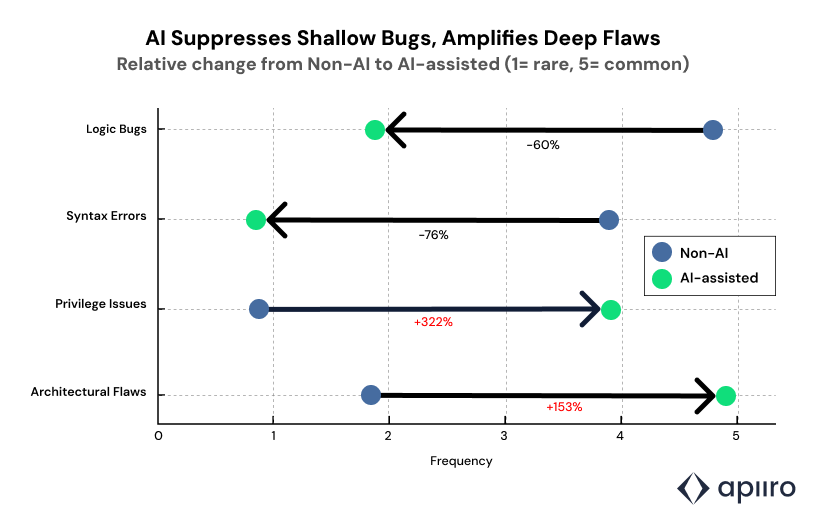

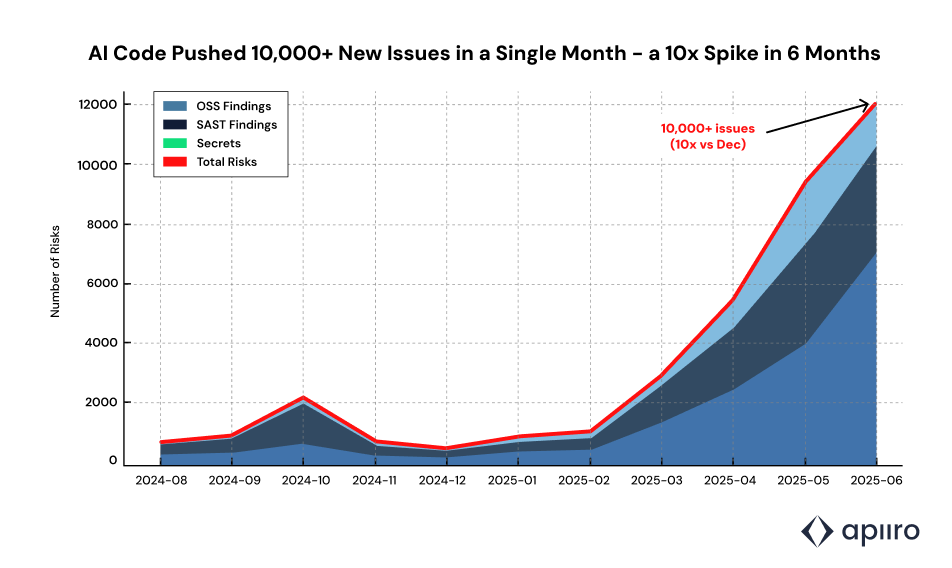

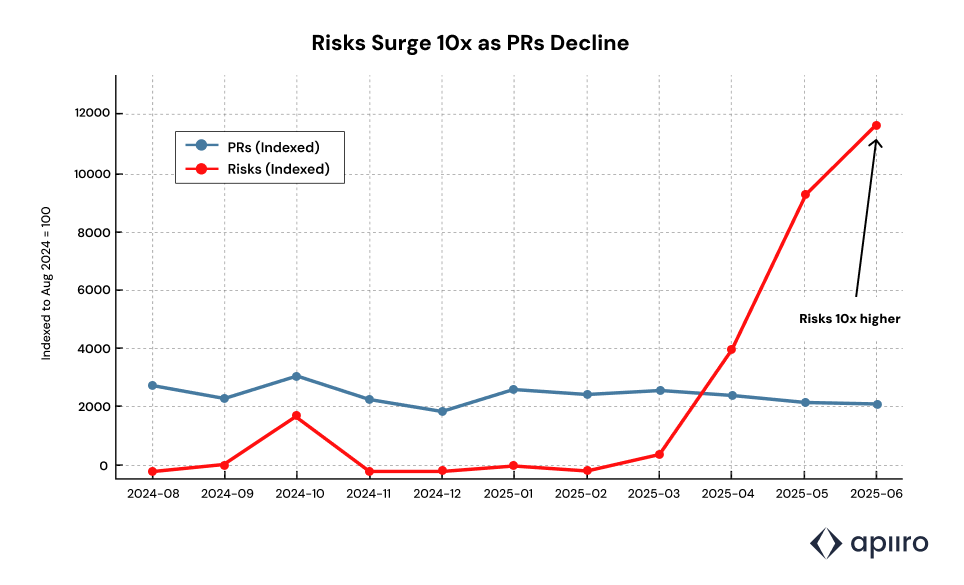

Furthermore, there are growing concerns about the quality and security of AI-generated code. Research has shown that code produced by AI assistants can introduce significantly more security vulnerabilities and design flaws than human-written code. For instance, by mid-2025, AI-generated code was linked to over 10,000 new security findings per month in studied repositories, representing a 10x increase in risks. Vulnerabilities include privilege escalation issues (up 322%) and other flaws tied to 38 Common Weakness Enumeration (CWE) categories. This creates a new set of problems for developers, who must now spend more time reviewing and debugging AI-generated code, potentially negating any initial time savings.

Source: Apiiro Ltd.

Source: Apiiro Ltd.

Source: Apiiro Ltd.

Wall Street’s Worries: A Correction on the Horizon?

The financial markets are also showing signs of nervousness. A recent report from Goldman Sachs warns that a slowdown in AI spending could lead to a significant correction in the stock market, with a potential 15-20% decline in the S&P 500. The report notes that while AI spending is currently strong, a deceleration is expected in late 2025 and into 2026, as companies shift focus from capex to other priorities like share buybacks.

This concern is echoed by a recent McKinsey report, which found that while AI adoption has increased to around 72% among companies, only a small percentage attribute a significant portion of their earnings to the technology. Over 80% of businesses using AI report no real gains in earnings, highlighting a disconnect between investment and financial returns—a classic indicator of a bubble.

The bubble appears more acute in private markets, where venture capital and startups like OpenAI face inflated valuations driven by speculation rather than performance. Nearly 500 private AI companies are now valued over $1 billion each, with an average of $5.4 billion, often based on potential rather than proven revenue. In contrast, large, diversified public companies like Google and Meta are less vulnerable, as their revenues span advertising, cloud services, and other sectors beyond pure AI plays. This disparity suggests that a burst could hit venture-backed firms hardest, while Big Tech consolidates its advantages.

Physical Barriers: Hitting the Wall on Infrastructure

AI’s explosive growth is increasingly constrained by physical limitations, particularly shortages in data center capacity and energy supplies. Projections indicate that global data center capacity will grow at 15% annually through 2027, but demand-driven largely by AI, may outpace this, leading to bottlenecks. Energy demand is a critical issue: AI’s global consumption is expected to reach 200 TWh in 2025, surpassing that of entire countries like Belgium. In the US alone, data center power needs could strain the grid, with 40% of AI data centers potentially facing shortages by late 2025 without new infrastructure.

These constraints could drive up costs significantly. Electricity for data centers is projected to more than double by 2030 and stifle innovation as companies compete for limited resources. Water usage for cooling is another concern, with massive facilities sprouting across regions already facing resource stress. Without rapid advancements in efficient computing or renewable energy integration, these barriers may force a slowdown in AI development, exacerbating bubble risks.

Acknowledging the Bubble from Within

Perhaps the most telling sign of a potential AI bubble comes from within the industry itself. OpenAI CEO Sam Altman has openly stated that he believes we are in an “AI bubble” and that investors are “overexcited.” This is a significant admission from the leader of one of the most prominent AI companies in the world.

Echoing this caution, Martin Eftimoski, a former economist for the Reserve Bank of Australia, has publicly revealed that he removed all AI investments from his pension, shifting entirely to cash. Eftimoski argues that business leaders often misunderstand AI’s actual usefulness, viewing it as a panacea rather than a tool with limited practical applications in many sectors. His warning underscores broader concerns about overhyped expectations driving unsustainable investments.

OpenAI’s own financials paint a picture of massive spending with an uncertain path to profitability. The company is reportedly burning through billions of dollars in cash, with projections of spending $115 billion through 2029 on infrastructure and operations. This high-burn, high-investment model is sustainable only as long as investor confidence remains high, but losses reached $5 billion in 2024 alone on $3.7 billion in revenue.

AI Adoption and Impact: A Data Overview

To contextualize the bubble debate, consider the following table summarizing key AI adoption and economic metrics from recent reports:

| Metric | Value | Source | Notes |

|---|---|---|---|

| Global AI Adoption Rate | 72-78% of organizations | McKinsey (2025), Stanford AI Index | Up from ~50% in prior years, but uneven across firm sizes. |

| Enterprises with Zero ROI on GenAI | 95% | MIT GenAI Divide (2025) | Despite $30-40B invested globally. |

| Decline in Large Firm AI Adoption | From 14% to 12% (2025) | US Census BTOS | First drop since 2023 tracking began. |

| Projected AI Energy Demand | 200 TWh (2025) | Various (IEA, etc.) | Equivalent to Belgium’s annual consumption; data centers to double demand by 2030. |

| Private AI Unicorns | ~500 companies | Elephas Report | Average valuation $5.4B, often speculative. |

| S&P 500 Potential Decline on AI Slowdown | 15-20% | Goldman Sachs | Due to capex deceleration in late 2025-2026. |

This data highlights the gap between adoption hype and tangible outcomes, reinforcing bubble concerns.

The Road Ahead: A Correction, Not a Collapse

While the evidence for an AI bubble is compelling, it’s important to note that a bursting bubble doesn’t necessarily mean the end of AI. The dot-com bust of the early 2000s, for example, was followed by a period of consolidation and the rise of the internet giants we know today.

A similar scenario is likely for AI. The current hype may be unsustainable, and a market correction may be inevitable. However, the underlying technology is real and transformative. The companies that survive the correction will be those that can demonstrate real-world value and a clear path to profitability. For now, the message is clear: proceed with caution. The AI revolution is here to stay, but the road ahead may be bumpy, especially as infrastructure limits and ROI realities set in.

Sources

AI’s Trillion-Dollar Shakeout: Navigating a Potential Bubble, Correction, Or Market Reset - Forbes

How Tech Giants Have Manipulated the AI Market to Their Advantage - AI Now Institute

Analyzing the Possibility of an Artificial Intelligence Bubble - Built In

Former RBA Economist Expresses Concerns Over an AI Bubble, Moves Superannuation to Cash - News.com.au

Can the U.S. Infrastructure Support the Growing Demands of the AI Economy? - Deloitte

Over 25 Key Statistics and Trends for AI Data Centers in 2025 - The Network Installers

Potential Power Shortages for AI Data Centers by 2025 - PCMag

AI Adoption Declining Among Large Companies, According to U.S. Census Bureau - Tom’s Hardware

Gartner’s 2025 Hype Cycle for AI: Moving Beyond Generative AI - Gartner

The Paradox of AI Coding Assistants and Their Impact on Productivity - Cerbos

AI Coding Assistants Increase Development Velocity but also Security Vulnerabilities - Apiiro

Goldman Sachs Issues Warning: A Slowdown in AI Could Negatively Impact the Stock Market - Yahoo Finance

MIT Report Finds 95% of Corporate Generative AI Pilots Are Unsuccessful - Fortune

Sam Altman’s Warning of an AI Bubble and Overvaluation Concerns - Yahoo Finance

OpenAI’s Projected Business Losses of $115 Billion Through 2029 - Reuters